Forex Brokerage Technology Requirements

November 22, 2019

Internal Technology:

A Forex Brokerage Needs to have the capability to support its business and its Clients services, through technology a Forex Brokerage has the capability to achieve effectiveness and efficiency, a thorough research was done to provide the relevant information below, this information will be illustrated to fully aware Apexum’s client’s of the best Practice’s and Procedure’s needed to achieve the required goal’s a Brokerage need’s.

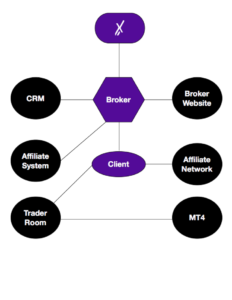

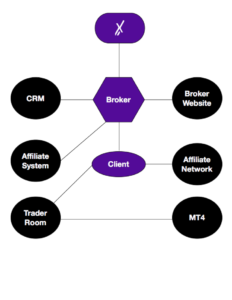

As seen in the diagram above, a Forex Brokerage needs to have the competencies in providing services to its clients, a Brokerage must have at first its own capability in order to provide clients with such services, in conclusion the technology diagram can be categorized into two section, these will be explained below:

- Broker:

- Website:

Design: A Broker Needs to have a website that is User Experienced and interfaced design (UX/UI), to which the Framework of the website is build on customer anticipation and prediction of client action (many designer’s are aware and capable of doing so in designing a website)

Page Number: A Forex Brokerage website needs to range from 10 – 15 Pages, an example is provided in this website: http://fxlinked.com/.

Content: Relative and Descriptive.

- Customer Relationship Management (CRM):

Management: A Brokerage Needs to have a CRM in order to manage clients whether their new clients or potential ones, a CRM gives the capability of having information about a Brokerage clients and managing them, this gives a Brokerage an advantage of being efficient and effective in complying to their client’s needs, an example is provided to give a conceptualizing idea of a CRM: http://www.apexum.com/crm.

- Affiliate System: A Brokerage Needs to have an Affiliate network, an Affiliate Network is one digital channel used in marketing, it is used by Forex Brokerage’s as it is one effective method in client acquisition (High conversion rate), it gives a competitive advantage over other Digital Channels as it guarantees a Lead to a Brokerage in exchange of commission.

http://www.apexum.com/affiliate-system

- Client:

- Trader Room:

the central hub where Forex Brokerage clients can manage their accounts and trading activities with their Brokerage. Within the Trader Room area, a Forex Brokerage has the ability to access a wide range of features such as registration, opening new accounts, deposits and withdrawals, uploading documents, Fund transfer between multiple accounts and even contacting a client service representative.

http://www.apexum.com/trader-area

- Trading Platform:

A type of trading software used to help currency traders with forex trading analysis and trade execution. Currency trading platforms provide charts and order-taking methods, These platforms could be leased (White label, Grey Label) or bought by a forex brokerage, there are a few providers of these platforms as they are highly costly to maintain and develop.

Platform Providers:

- Metaquotes: MetaTrader 4, MetaTrader 5

- ACT Forex: ACT Trader.

And many more.

External Technology:

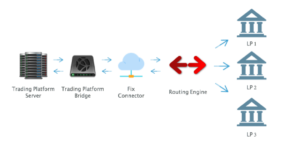

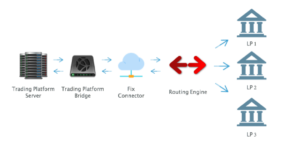

A Forex Brokerage needs to have certain Technology in order to connect with the Forex Market and provide the Service feeds for the Brokerage clients, these are the External Required Technology needed to be established in order to provide the services intended for the Brokerage end-clients.

A Trading platform such as the MT4 (MetaTrader 4) consists of both a client and server component. The server component is run by the broker and the client software is provided to the brokerage’s client’s, who use it to see live streaming prices and charts, to place orders, and to manage their accounts.

- Trading Platform ECN Bridge: A technology which allows users to access interbank foreign exchange market through the MetaTrader 4 (MT4) electronic trading platform. MT4 was designed to allow trading between a brokerage and their client’s, brokers do not operate the bridge, so a Forex Brokerage client’s get the prices as they are from the liquidity providers.

- STP (Straight Through Processing Bridge): Straight-through processing bridge software has been developed over the years to allow the MT4 server to pass orders placed by clients directly to an ECN (Electronic Communication Network and feed trade verification back automatically.

Allows attaching MetaTrader system to any FIX compliant destination, such as brokers, exchanges, ATS. It supports all asset classes and order types which are available in MetaTrader. Groups of MT4 accounts could be structured in a way to route orders to a specified destination.

Handles communication with various Liquidity Provider’s via FIX protocol and allows to dynamically change the hedging parameters (forex brokers can switch on/off particular LP, add markup etc.)