Starting a Forex Brokerage

November 22, 2019

- Starting a Brokerage

Forex Brokerage business model is segmented into different factors, there are:

- Straight Through Processing Broker (STP)

- Electronic Communications Network Broker (ECN)

These Foreign Exchange Brokerage’s are usually referred to as Non-Dealing Disk Brokers.

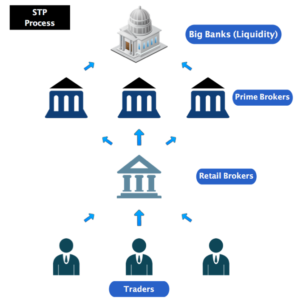

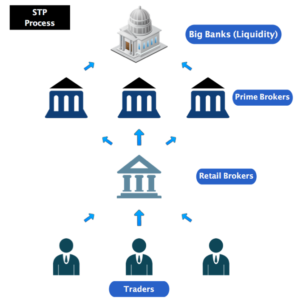

- Straight Through Processing (STP):

- Definition: Straight through processing (STP): A procedure that financial companies use to optimize the speed at which they process transactions. This is performed by allowing information that has been electronically entered to be transferred from one party to another in the settlement process without manually re-entering the same pieces of information repeatedly over the entire sequence of events. (i.e. A Forex Brokerage sending clients transactions automatically from its platform to its liquidity provider: A-Model).

Business Model:

- Spread: Difference between ask and bid price, Calculated in Pip’s.

Customer Buys currency USD/GBP with a difference in spread of 1.8 Pip’s,

The spread is automatically lost by the client once he places an order on his platform, this simply is a calculation of profit on the broker and liquidity provider side, to which the broker profits from the 1 Pip and the 0.8 goes to the liquidity provider.

- Commission: Developing Countries: Ability to charge up to 4 – 5 Pip’s.

Secondary Countries: Ability to charge 1 – 2 Pip’s.

- Revenue Stream: Spread, Commission, profit is achieved from efficiency of Brokerage Client Trade’s (Commission per Trade).

- Risk Level: Low

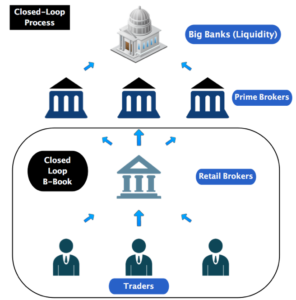

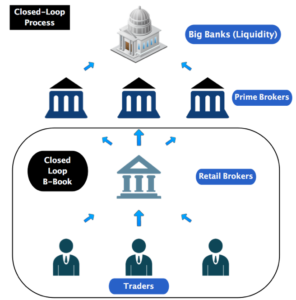

- Closed Loop Dealing Desk

- Definition: Closed Loop Dealing Desk: A procedure that a Forex Brokerage implies to which a client buys and sells through a Forex Broker, the Forex Broker, at the same time, is a counter-party of a deal. If clients get profit, a broker bears a loss, and vice versa. Most of the clients of a Forex Broker have no experience at the Forex exchange market, (i.e. A Forex Brokerage counter-parties his client’s transactions from the trading platform to which the Forex Broker keeps the client’s trades In-House: B-Model).

Business Model:

- Spread: Difference between ask and bid price, Calculated in Pip’s.

Customer Buys currency USD/GBP with a difference in spread of 1.8 Pip’s,

The spread is automatically lost by the client once he places an order on his platform, this simply is a calculation of profit on the broker and liquidity provider side, to which the broker profits from the 1 Pip and the 0.8 goes to the liquidity provider.

- Commission: Developing Countries: Ability to charge up to 4 – 5 Pip’s.

Secondary Countries: Ability to charge 1 – 2 Pip’s.

- Revenue Stream: Spread, Commission, profit is achieved from efficiency of a Forex Brokerage Client Trade’s (Commission per Trade), as well as B-Model, Counter-Partying clients (Client Loss = Forex Brokerage Profit).

- Risk Level: High (Client Profit = Forex Brokerage Loss).

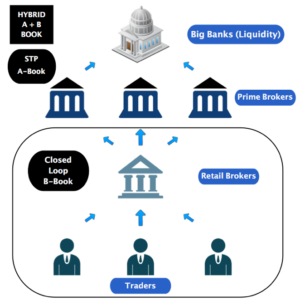

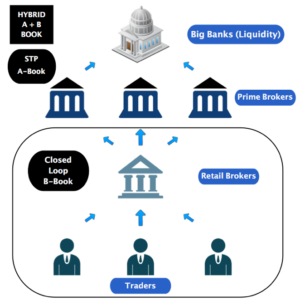

- Hybrid (STP + Closed Loop):

- Definition: A procedure to which Forex Brokerage uses both A-Model and B-Model, where the Brokerage sends a portion of its clients using Straight Through Processing (STP) to its Liquidity providers which is A-Model, and the B-Model where the Brokerage Counter-Party the other portion of its clients and profits from their client’s loss.

Business Model:

- Spread: Difference between ask and bid price, Calculated in Pip’s.

Customer Buys currency USD/GBP with a difference in spread of 1.8 Pip’s,

The spread is automatically lost by the client once he places an order on his platform, this simply is a calculation of profit on the broker and liquidity provider side, to which the broker profits from the 1 Pip and the 0.8 goes to the liquidity provider.

- Commission: Developing Countries: Ability to charge up to 4 – 5 Pip’s.

Secondary Countries: Ability to charge 1 – 2 Pip’s.

- Revenue Stream: Spread, Commission, profit is achieved from efficiency of Brokerage Client Trade’s (Commission per Trade), as well as B-Model, Counter-Part clients (Client Loss = Forex Brokerage Profit).

- Risk Level: Medium (Client Profit = Forex Brokerage Loss/Client Trades = Spread & Commission).