Fibonacci Levels – Methods to Use in Forex Trading

November 22, 2019

Technical analysis would be much poorer if it weren’t for the Fibonacci numbers. More precisely, the Fibonacci ratios brought together new trading concepts, strategies, and even theories.

Some traders use the Fibonacci method for trading and built a Forex trading system directly buying dips into Fibonacci levels or selling spikes in important ratios.

The name comes from an Italian mathematician that lived in the late 1100s. He traveled into the Arabic world and found that the way of doing complex math calculations was much more comfortable using Arab numbers. As it turned out, he introduced them in old Europe proving that the roman numbers were outdated.

He remained famous for the Fibonacci series of numbers that says that each number in the series is a sum of the previous two. The beauty of it is that the ratios these numbers appear, called the Fibonacci ratios, apply to various concepts surrounding our day-to-day living. For instance, the house of the snail, follows a Fibonacci ratio.

How to Use Fibonacci Ratios in Trading

Forex traders find great help in Fibonacci ratios. And, not only the currency traders, but all traders using technical analysis.

The widely used ratios are the retracement ones: 23.6%, 38.2%, 61.8%. Add to them the 50% level and put them on a relevant timeframe (bigger than the four-hour timeframe) and you’ll see the market reacting almost like magic on the levels, forming strong support or resistance areas.

Out of all Fibonacci ratios, one stands as the magical level every trader is aware off: the 61.8% ratio. Also known as the golden ratio, it was used, for instance, to bring together concepts part of famous trading theories like the Elliott Waves Theory.

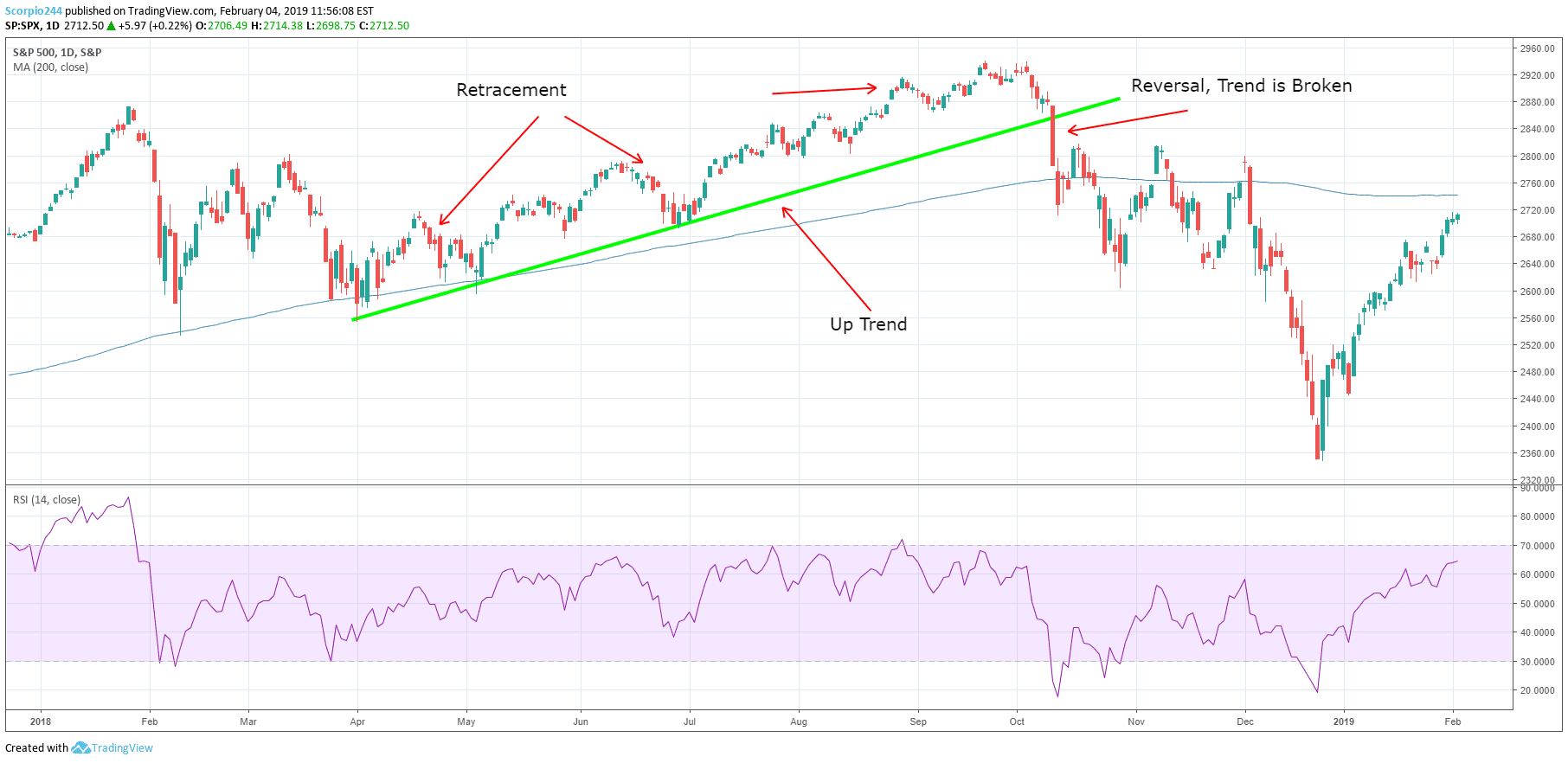

See the USDCHF daily chart from above? The price broke higher in an aggressive bullish trend, and then a correction began.

Forex traders draw the Fibonacci levels to find out the 61.8% in anticipation of a bounce. However, Forex trading is not an exact science, meaning that traders do not wait for levels to be reached within the last pip. Instead, it is more about an area where the market is supposed to react, just like it did in this case.

The Forex market has various applications for the Fibonacci ratios. For both retracement and expansion levels, the ratios sit at the core of a trading strategy that:

- Buys the 2nd wave retracement into the 50%-61.8% area when trading a bullish impulsive wave with the Elliott Waves Theory

- Finds the minimum extended level in the Elliott Waves Theory when using the 161.8% expansion

- Sets the appropriate target using the Gartley trading method

These are only a few ways to trade with the Fibonacci levels, and any Forex broker makes its clients aware of the power of the Fibonacci ratios.

Conclusion

Technical analysis would be much poorer without the Fibonacci levels. For instance, the Elliott Waves Theory, one of the most powerful theories that exist, would not make sense without Fibonacci’s integration that helps to put corrective and impulsive waves together.