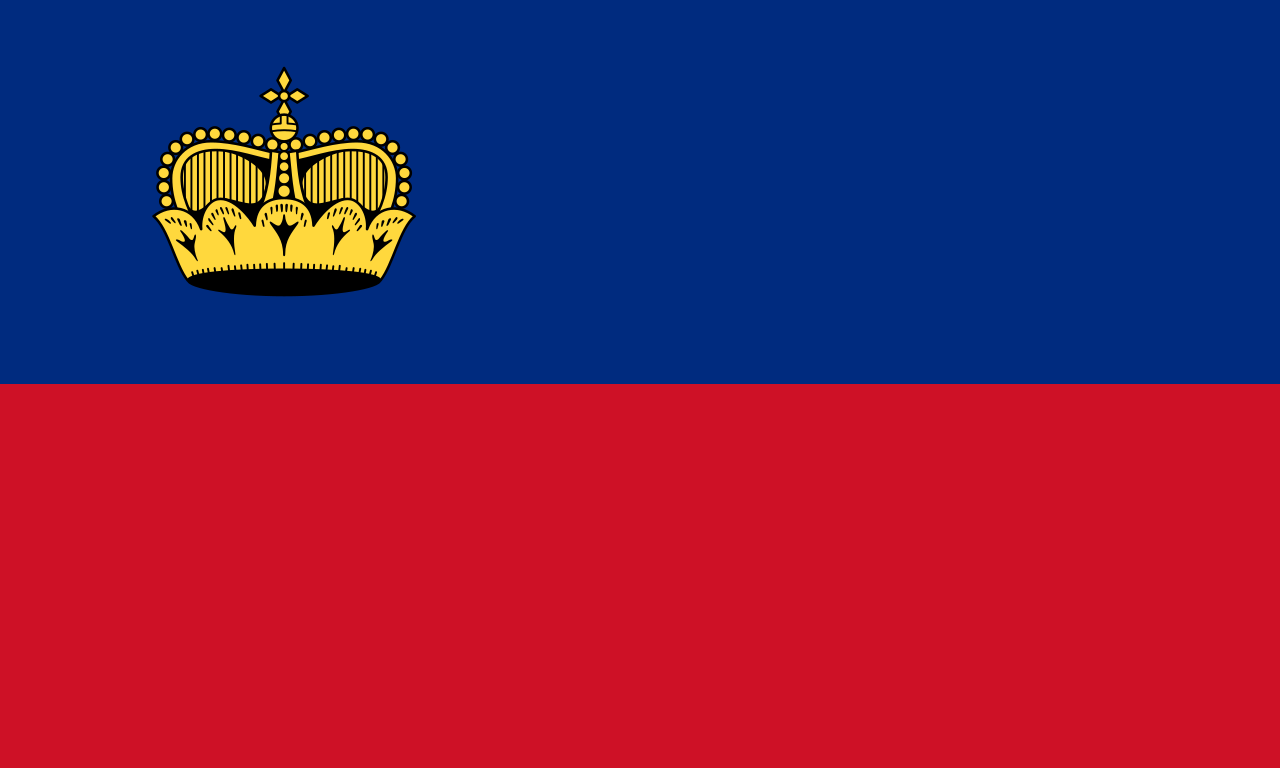

Liechtenstein is a member of the European Economic Area (an organization that acts as a bridge between the European Free Trade Association (EFTA) and the European Union) since May 1995. Its economy, despite its small size and scarcity of natural resources, is highly industrialized, free-enterprise oriented and has the third highest per capita income in the world, after Qatar and Luxembourg. It has an important financial center, specialized in financial services for foreign entities and wealth management for non-resident individuals.

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES