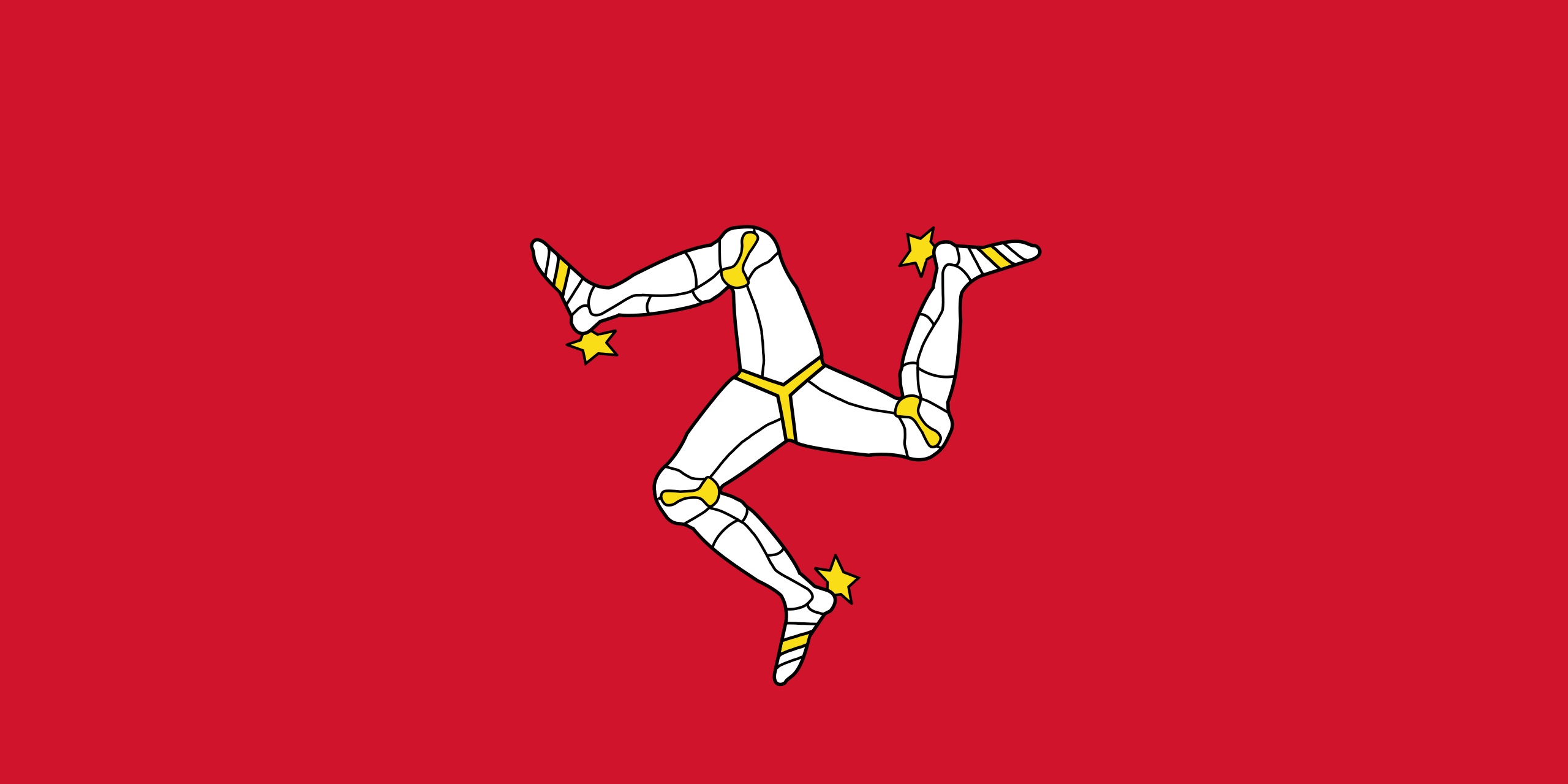

Set up an Isle of Man company limited by shares

The Isle of Man is a high-reputable international finance and international business center due to its political stability, business-friendly policies and an attractive fiscal and regulatory environment.

Companies incorporated in the Isle of Man are subject to corporate income tax at a 0% rate. A 10% tax rate for companies engaged in the financial services business and Isle of Man’s property transactions.

Dividend distributions, royalties, and interests paid to non-Manx residents are subject to withholding tax at the rate of 0%.

The Isle of Man is a signatory to the Paris Convention on Patents and Trademarks, making the Isle of Man limited company an interesting vehicle to hold intellectual property.

The Isle of Man has also enacted legislation for businesses dealing with cryptocurrencies. The Designated Business (Registration and Oversight) Act 2015 regulates cryptocurrency businesses, such as exchanges, and requires them to register with the Isle of Man Financial Supervision Commission and comply with Anti-Money Laundering and Countering Terrorist Financing legislation and the Proceeds of Crime Act 2008.

The country has also a strong E-Gaming industry, due to its gaming license simple application process, low betting duties, its extensive cluster of services providers/advisors with experience in the industry and its supportive legislation.

All in all, an Isle of Man company is an excellent vehicle for movable and immovable assets holding, investments companies and SPVs, and e-gaming.