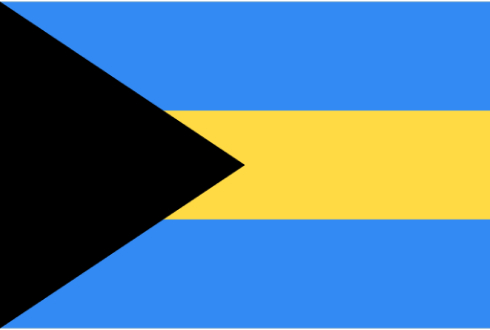

Set up a company in Bahamas

The Bahamas is one of the industry veterans when it comes to offshore financial services. Since the 30s and 40s, the jurisdiction has been attracting foreign wealth due to its absence of taxation and its confidentiality policies. Although it lost popularity after its independence from Great Britain back in 1973, in favor of Cayman, BVI or Bermuda, it is still one of the go-to jurisdictions in terms of offshore corporate, trust and banking services.

Last December 2018, the Bahamas implemented several legislative changes to comply with requirements set by the EU and the OECD, by enacting the Removal of Preferential Exemptions Act; Commercial Entities (Substance Requirements) Act; the Register of Beneficial Ownership Act; and the Multinational Entities Financial Reporting Act

The Removal of Preferential Exemptions Act abolishes ring-fencing features provided by the International Business Companies Act; the Exempted Limited Partnership Act; the Investment Condominium Act, 2014; and the Executive Entities Act, 2011 – which provided companies incorporated by non-residents to enjoy certain exemptions if they were operated completely outside of the Bahamas.

Because the Bahamas doesn’t levy corporate taxes the main impact for IBCs or Limited Partnerships doing business outside of the Bahamas is that now they will be required to obtain a business license and pay a certain annual fee, as well as stamp duty on certain instruments. Limited duration companies under the International Business Act have been abolished.

Companies incorporated on or before December 31, 2018, are grandfathered for three years, until December 31, 2021.

Furthermore, international banking, insurance, and securities/capital markets sectors will be able to offer services to residents in the Bahamas and in local currency once certain regulatory approvals are in place. On the other hand, local commercial banks will be able to provide services to international clients.

Bahamian International Business Companies are commonly used as holding companies, to hold bank accounts, financial and commercial titles, international trading, own movable and immovable properties, asset protection and estate and inheritance security, among others.