Being part of The Netherlands’ Caribbean Antilles, Curaçao, with its close connectivity to Europe and its stable political and economic environment, is an ideal jurisdiction to establish financial operations. Forming part of the Kingdom of the Netherlands, Curaçao is an associate member of the European Community, with the Supreme Court of the Netherlands serving as the highest legal authority. Curaçao’s ideal geographical location and close connectivity to Europe and its stable political environment make Curaçao the ideal financial focal point for doing business.

- GAMING LICENSE

- Curacao Gaming License Costs

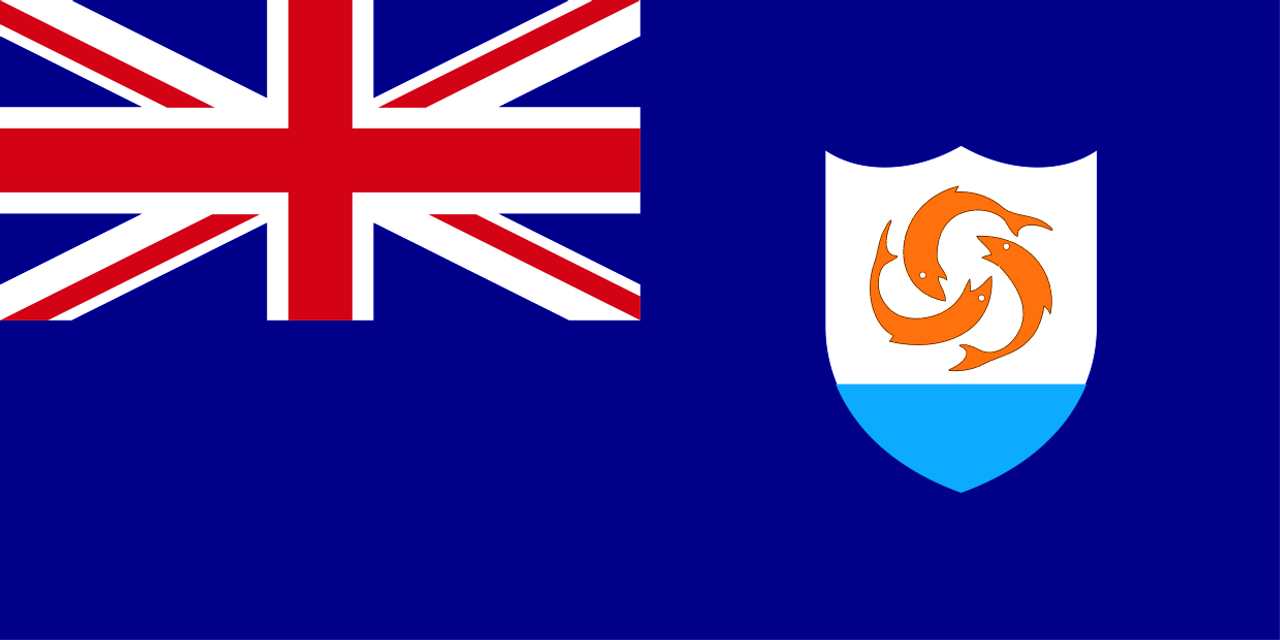

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES