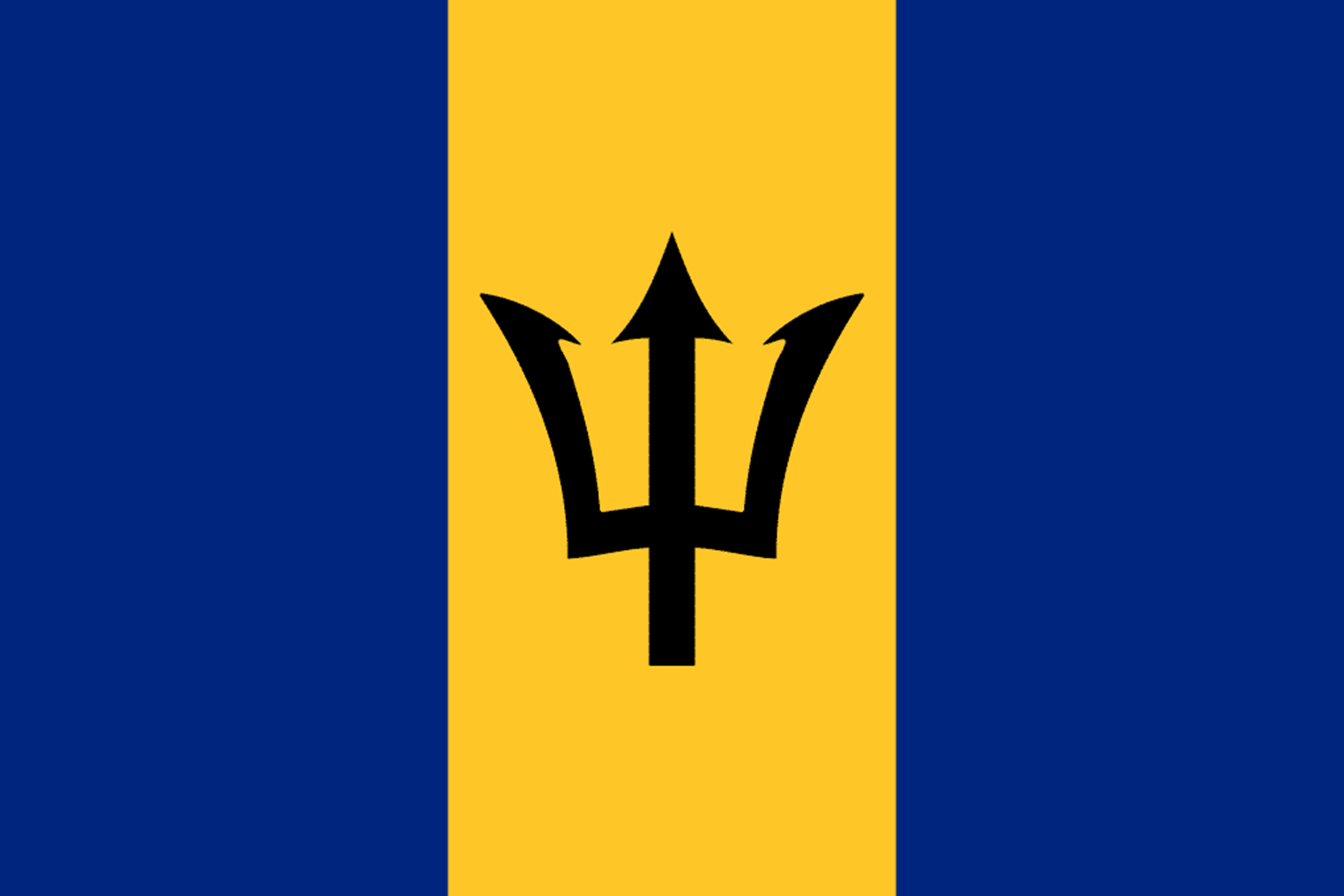

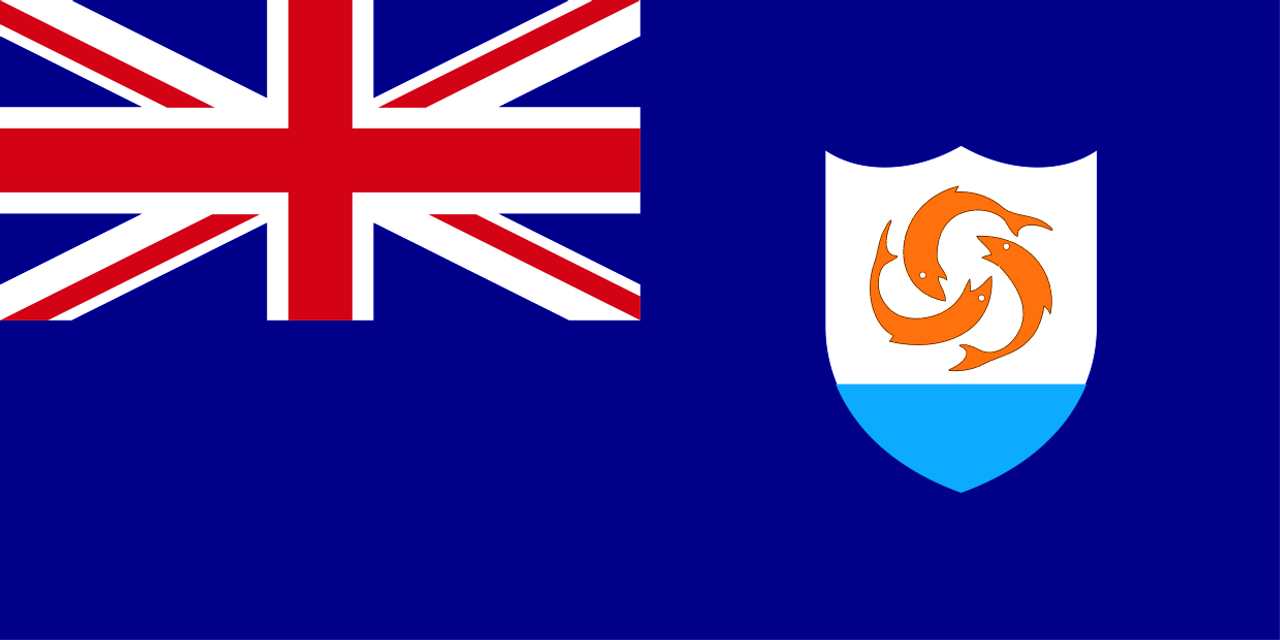

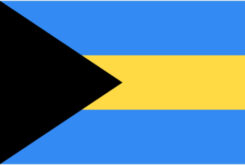

Barbados is an independent Caribbean island nation with a developed economy. The capital is Bridgetown. Facilities for tourism are widely available. The U.S. Embassy in Barbados has consular responsibility for Antigua and Barbuda, Dominica, St. Kitts, and Nevis, St. Lucia, St. Vincent, and the Grenadines, as well as the British dependent territories of Anguilla, British Virgin Islands, and Montserrat, and the French islands of Martinique, Guadeloupe, St. Barthélemy and St. Martin.

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES