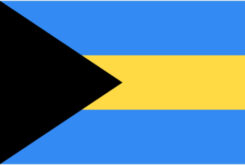

The Bahamas is one of the industry veterans when it comes to offshore financial services. Since the 30s and 40s, the jurisdiction has been attracting foreign wealth due to its absence of taxation and its confidentiality policies. Although it lost popularity after its independence from Great Britain back in 1973, in favor of Cayman, BVI or Bermuda, it is still one of the go-to jurisdictions in terms of offshore corporate, trust and banking services.

The Bahamas is one of the biggest financial centers of the Caribbean, with financial services producing some 15 percent of GDP and being the second-largest industry after tourism. The country’s legislation and regulatory structure, comparatively highly-skilled workforce, and its stable government have attracted the some of the most prestigious financial institutions from around the globe.