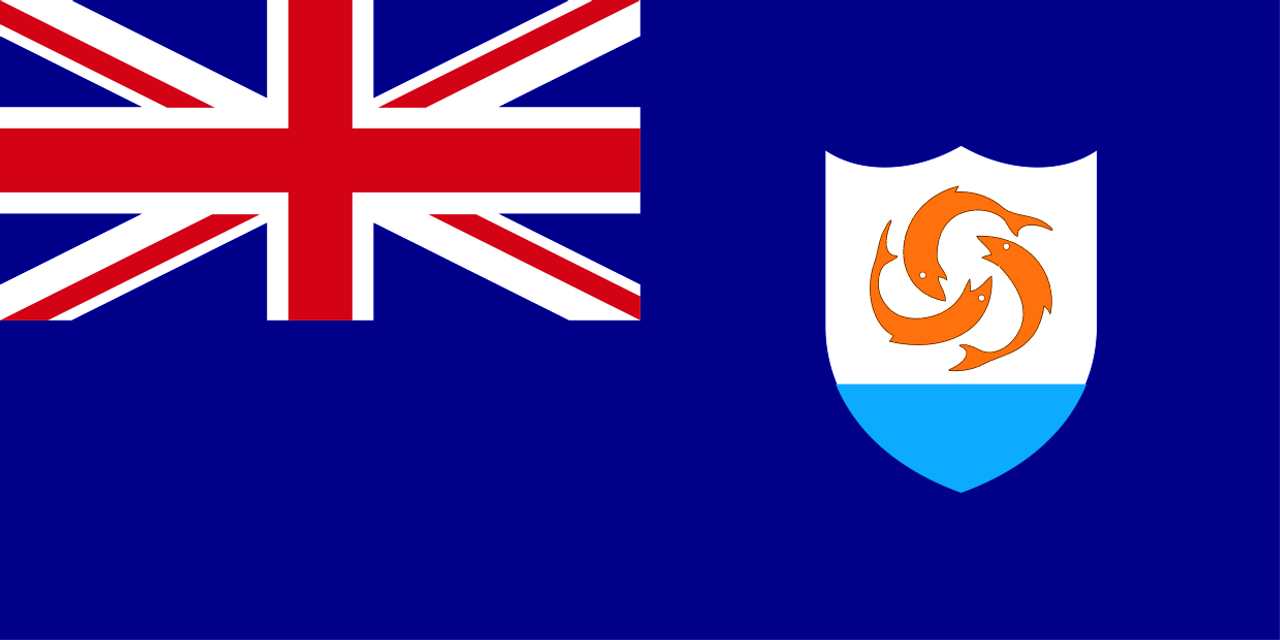

Antigua and Barbuda offers the traditional services of an Offshore Financial Center, including the formation of Antigua offshore companies, bank accounts and the provision of financial services. Antigua and Barbuda’s banking sector is the second largest in the Eastern Caribbean region, accounting for one fifth of the region’s deposits, assets, and loans.

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES

- GAMING LICENSE

- Curacao Gaming License Costs

- Anjouan Gaming License

- Moheli Gaming License

- Malta Gaming License

- Tobique Gaming License

- Kahnawake Gaming License

- Isle of Man Gaming License

- Vanuatu Gaming License

- USA

- Online eGaming Licensing

- Crypto online casino license

- Online casino license for sale

- Compare gaming licenses

- International Association of Gaming Regulators

- Cheapest online gambling license

- Offshore gaming license costs

- Gaming license application

- Gaming business plan

- 12 FAQs for setting up new gaming businesses

- Online casino software solutions

- White label online casino solutions

- FOREX LICENSES

- CRYPTO LICENSES

- INCORPORATION & BANKING

- RESOURCES